Enter assets record:

We design a complete asset calculation solution to help you

1. Easily master depreciation calculation

2. Flexibly change the commercial ratio

3. Track depreciation records every year

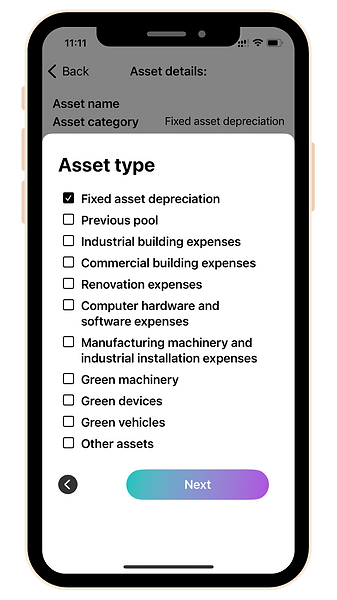

Will automatically classify according to asset type

Fixed assets are classified as

10% / 20% / 30% Pool

or Non Pool item

1. Click the asset button below to enter the page

2. Click on the '+' button in the lower right corner

3. Select input method

Text input

Select from gallery

Select from document

Take photo

On/Off

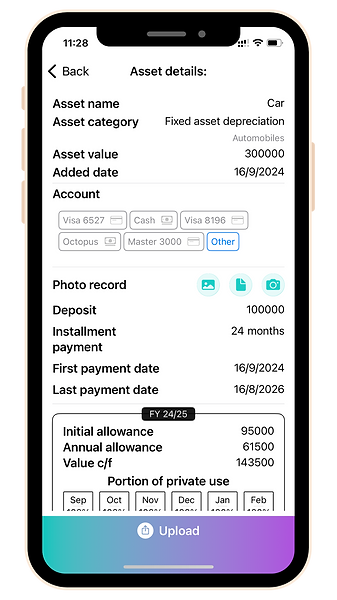

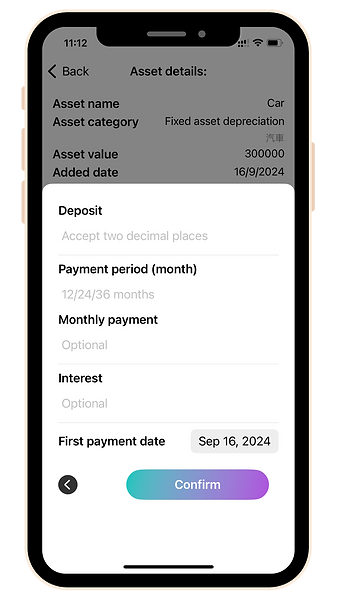

Assets that can be paid in installments can also be handled

Example of adding fixed assets record

Select Spending Account

Automatically calculate the depreciation allowance for the fiscal year

The commercial ratio can also be adjusted freely

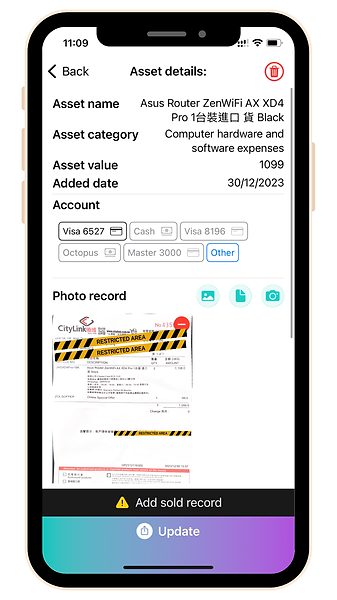

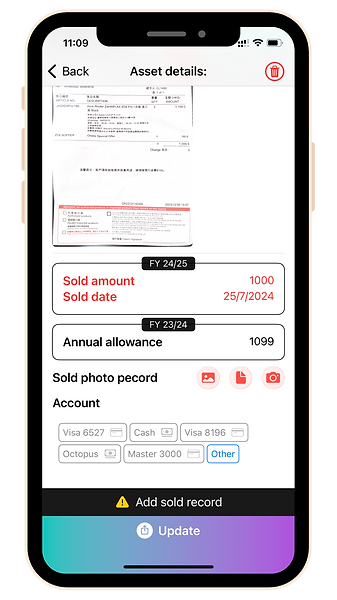

Sold Record

Automatically update tax allowance after sale

Non-fixed asset examples

Asset Classification

We will update accordingly

The following assets will be exempt from tax for the year:

1. Fixed assets - divided into 10% / 20% / 30% Pool

2. *Industrial construction costs - construction costs for industrial use areas

3. * Commercial construction expenses - Construction and renovation expenses for commercial purposes (20% tax allowance per year)

4. Manufacturing industry machinery and industrial equipment expense

5. Computer hardware and software expense

6. Green machines/equipment/vehicles

* Expense on property purchases for business operations are capital in nature and are eligible for an initial 20% tax allowance for industrial buildings.

*Annual 4% tax allowance for industrial and commercial buildings.

Fixed assets -

60% initial tax allowance in the year of purchase and % annual allowance of the group to which the asset belongs each year

10% Pool

Air conditioning

Industrial equipment

Bank safe deposit boxes, doors and iron bars Cables

Light poles (street) - gas or electric Lifts and escalators (electric)

Mains pipe duct (gas or water)

Fuel tank vessels, sailboats, sampans, barges and tugboats

Water sprayers

30% Pool

20% Pool

Household appliances

Furniture (excluding soft furnishings)

Indoor air conditioning systems

achts, ferries and hydrofoils

Taxi meters

Lead and printing plates

Aircraft (including machinery)

Syphons for use in bars

Bicycles

Bleaching and finishing machinery and industrial equipment

Concrete pipe moulds

Rice cookers and electric kettles

Electronic data processing equipment

Manufacturing machinery and industrial equipment (electronics, plastics, silk, sulphuric acid and nitric acid, textiles and clothing)

Cars

Outboard engines Trucks

Tractors - Mud scrapers and road rollers

Weaving, spinning, knitting and sewing machines

According to our accounting team’s experience,

the calculation of asset tax allowance is very complicated.

We hope to ensure that users will not miss a single cent.

Each asset is calculated independently and

Tax allowance amount of each asset is calculated every year.

%20(5)_edited.png)